Relocating to London is always a big decision. Not only do you have to pack up your life and transport it halfway across Europe, but you also have to be willing to leave your friends and family behind to make a new life in the big city.

During the buildup to the move, you’ll have to spend what will likely feel like a lifetime sorting out lease agreements, signing job contracts, and filling out visa paperwork if you’re coming from outside the EU.

Although the end result is worth it (I mean, who wouldn’t want to live in one of the most vibrant and diverse tech cities in Europe?), getting there may seem like a never-ending struggle that is exhausting enough to put most people off.

After moving here, you’ll start to notice something strange about your life in London.

In all likelihood it will creep up on you; you’ll start noticing that your euros just aren’t going as far in your new home as you would like them to. Now, you’d be forgiven for thinking that this is all down to London prices (and to an extent, it is), but what punishes the pounds in your pocket more than your rent or the price of a cup of coffee is something that at first you might not realise.

That’s right — exchange rates.

As anyone who travels knows, making sure that your hard-earned euros or pounds convert to your target currency at the best rate is incredibly important. Throwing away money that you’ve worked hard to earn on poor exchange rates is unnecessary, and it just helps to bulk up someone’s bottom line.

Thankfully, getting the best conversion rate is now incredibly simple. The business of currency exchange has gone through some dramatic changes recently, and TransferWise has emerged as the new leader.

Making exchange rates transparent

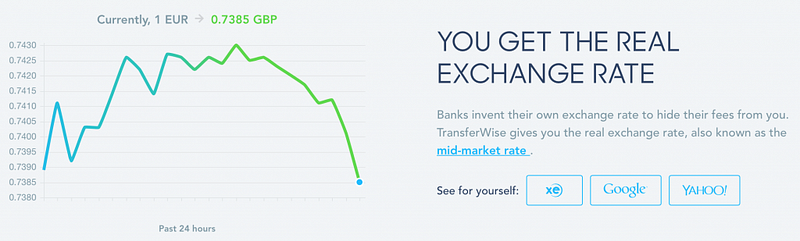

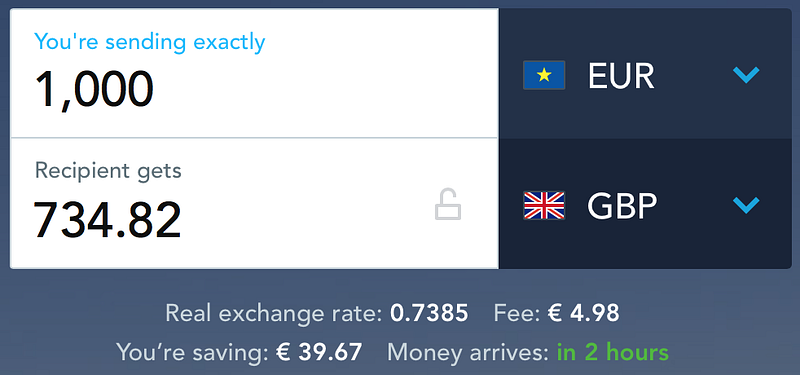

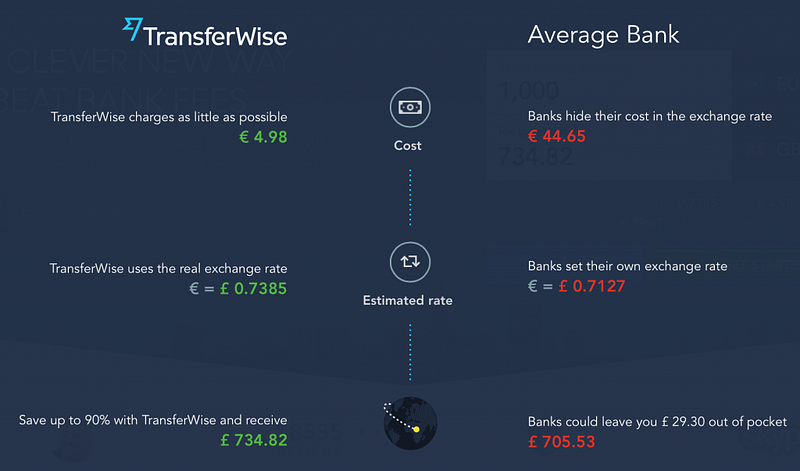

TransferWise charges you a very small fee and converts your money at the mid-market rate, which guarantees that you get the absolute best conversion possible. This means that you won’t be stung by a combination of high fees and poor conversions, and that the money you have already earned will go as far as possible in your target country.

Say you wanted to convert €1,000 to pounds sterling and deposit it in your brand new UK bank account for a deposit on a flat. If you used a traditional bank to bank transfer, you would end up with £705.53, whereas if you used TransferWise, you would have a grand total of £734.82. So by simply switching currency exchange provider, you can save yourself £29.30 of your own money that would have been needlessly wasted on bank fees. Over time, these lots of £29 can seriously add up and can make a big difference to your day-to-day life in your new British home.

TransferWise is able to save you lumps of your own cash by matching your intended currency exchange with someone else who’s looking to exchange in the other direction. So, if you’re looking to exchange your euros for pounds, TransferWise matches you with someone who is looking to exchange pounds for euros, and then processes your exchange at the mid-market rate, so you both get the best conversion. TransferWise also processes 90% of transactions within one day, so you can make sure you get the money you need as soon as possible.

If you haven’t heard of TransferWise before, don’t worry; they’re backed by superstar investors like Peter Thiel (founder of PayPal) and Richard Branson (of Virgin fame), and they’re regulated by the Financial Conduct Authority right here in London — oh, and they also happen to be a client of ours (and we only work with the best), so you can rest assured that your money is in safe hands.

Sending money with TransferWise is really simple:

- Go to TransferWise.com

- Click the button that says ‘Sign Up’

- Fill in your details or log in using your Facebook or Google account

- Decide how much money you would like to transfer — it tells you exactly how much you’ll get in return

- Add your own details, and the details of the account you’d like to send the money to

- Confirm those details

- Upload the money you’d like to transfer and confirm

- TransferWise does the rest

Right now, TransferWise allows you to treat your friends with a free transfer up to £3000. For every three friends who sign up with your personalised referral link and use up their free transfer, TransferWise treats you with £50 as thanks for your help. To create an account, follow the link and receive a free transfer. It’s on me 😉

When it comes to relocating to London, there’s a lot to think about and plan, but thankfully, now that services like this exist, worrying about getting the most out of your money doesn’t have to be one of them!

PS: If you’re looking to work in London, check out our offers. We even have a couple for TransferWise!

0 Comments